Private Beaches and Exclusive Access: Investing in Greece’s Ultra-Premium Real Estate

Reading time: 15 minutes

Table of Contents

- Introduction to Greece’s Luxury Real Estate Market

- The Allure of Private Beaches in Greek Properties

- Key Regions for Ultra-Premium Real Estate

- Economic Factors Driving the Luxury Market

- Legal Considerations for Foreign Investors

- The Impact of Tourism on High-End Properties

- Sustainability and Eco-Luxury Trends

- Investment Strategies for Ultra-Premium Greek Real Estate

- Future Outlook for the Greek Luxury Property Market

- Conclusion

- FAQs

1. Introduction to Greece’s Luxury Real Estate Market

Greece, with its rich history, stunning landscapes, and Mediterranean charm, has long been a sought-after destination for luxury real estate investors. In recent years, the country’s high-end property market has experienced a significant transformation, driven by a combination of economic recovery, increased foreign investment, and a growing demand for exclusive, private spaces.

The ultra-premium segment of Greece’s real estate market is characterized by properties that offer unparalleled privacy, breathtaking views, and world-class amenities. Among these, villas in kalamata and other coastal regions have become particularly coveted, offering investors the rare opportunity to own a slice of Mediterranean paradise complete with private beach access.

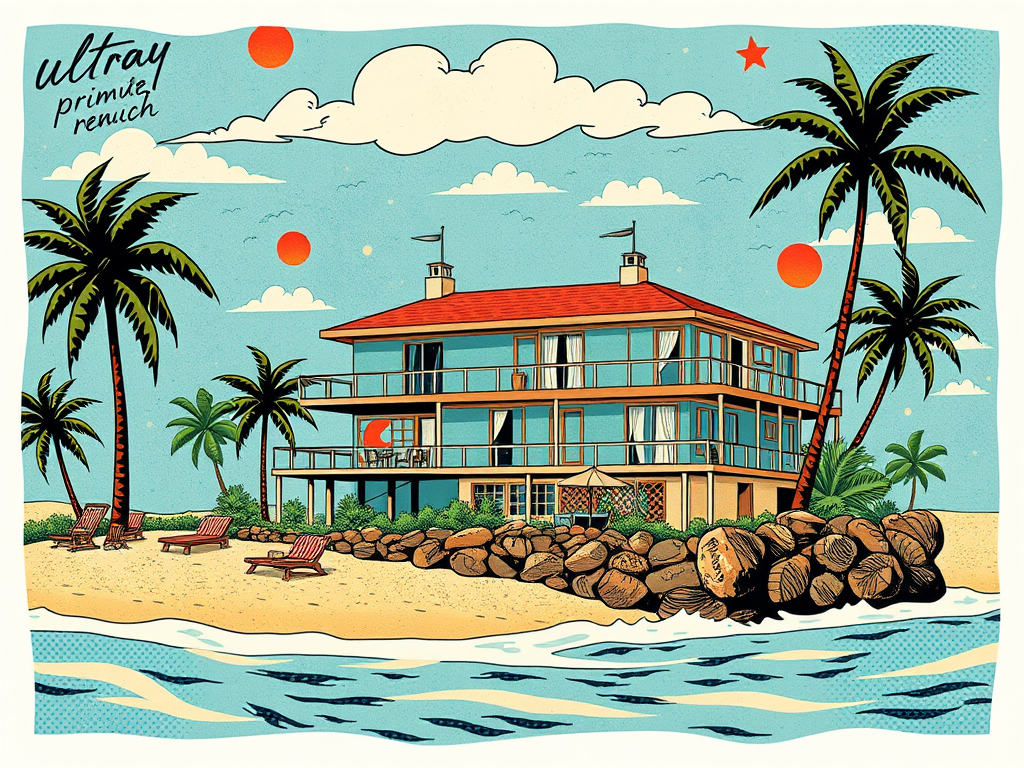

2. The Allure of Private Beaches in Greek Properties

One of the most enticing features of ultra-premium real estate in Greece is the possibility of owning property with private beach access. This exclusivity not only enhances the lifestyle appeal but also significantly boosts the investment value of such properties.

2.1 The Rarity Factor

Private beaches are a scarce commodity, especially in popular tourist destinations. In Greece, strict coastal protection laws limit the development of beachfront properties, making those with private beach access even more valuable.

2.2 Privacy and Security

For high-net-worth individuals and celebrities, private beaches offer a sanctuary away from public scrutiny. This level of privacy is a key selling point in the ultra-premium market segment.

2.3 Investment Potential

Properties with private beaches tend to appreciate at a higher rate compared to other luxury properties. They also offer excellent rental potential, appealing to discerning travelers seeking exclusive accommodations.

3. Key Regions for Ultra-Premium Real Estate

While Greece offers numerous locations for luxury real estate investment, certain regions stand out for their ultra-premium offerings:

3.1 Mykonos and Santorini

These Cycladic islands are synonymous with luxury and exclusivity. Properties here often feature stunning Aegean views and private infinity pools.

3.2 Athens Riviera

The coastal suburbs of Athens, including Vouliagmeni and Glyfada, offer proximity to the capital while providing a resort-like atmosphere.

3.3 Peloponnese

This region, including areas like Kalamata, is gaining popularity for its unspoiled beaches and potential for large, secluded estates.

4. Economic Factors Driving the Luxury Market

The Greek luxury real estate market is influenced by various economic factors:

4.1 Economic Recovery

Greece’s gradual economic recovery post-2008 crisis has restored investor confidence, particularly in the high-end market.

4.2 Golden Visa Program

Greece’s residency-by-investment program has attracted significant foreign investment, especially in properties valued over €250,000.

4.3 Low Interest Rates

The prevailing low interest rate environment in Europe has made luxury property investments more attractive.

5. Legal Considerations for Foreign Investors

Investing in Greek real estate, especially in the ultra-premium segment, requires careful navigation of legal and regulatory frameworks:

5.1 Property Ownership Laws

While Greece generally allows foreign ownership of real estate, certain border areas and islands may have restrictions.

5.2 Tax Implications

Understanding the tax landscape, including property taxes, capital gains tax, and potential rental income taxation, is crucial for foreign investors.

5.3 Due Diligence

Thorough due diligence is essential, particularly for properties with private beach access, to ensure compliance with coastal protection laws.

6. The Impact of Tourism on High-End Properties

Greece’s thriving tourism industry significantly influences the ultra-premium real estate market:

6.1 Rental Potential

Luxury properties, especially those with private beaches, offer substantial rental income potential during peak tourist seasons.

6.2 Infrastructure Development

Ongoing improvements in tourism infrastructure, including airports and marinas, enhance the appeal of luxury properties in popular destinations.

6.3 Seasonal Considerations

The seasonal nature of Greek tourism affects property management and potential rental strategies for investors.

7. Sustainability and Eco-Luxury Trends

The ultra-premium real estate market in Greece is increasingly embracing sustainability:

7.1 Eco-Friendly Design

Many new luxury developments incorporate sustainable materials and energy-efficient technologies.

7.2 Environmental Certifications

Properties with green certifications are gaining popularity among environmentally conscious high-net-worth buyers.

7.3 Conservation Efforts

Some ultra-premium properties are involved in local conservation efforts, particularly those with private beach access.

8. Investment Strategies for Ultra-Premium Greek Real Estate

Investing in Greece’s high-end property market requires a strategic approach:

8.1 Long-Term Appreciation

Many investors focus on the long-term appreciation potential of prime locations, particularly those with limited supply.

8.2 Rental Yield Optimization

Balancing personal use with strategic rental periods can maximize returns on investment.

8.3 Portfolio Diversification

Ultra-premium Greek real estate can serve as a valuable diversification tool for high-net-worth individuals’ investment portfolios.

9. Future Outlook for the Greek Luxury Property Market

The future of Greece’s ultra-premium real estate market looks promising:

9.1 Continued Foreign Interest

The Golden Visa program and Greece’s growing reputation as a luxury destination are likely to sustain foreign investment.

9.2 Infrastructure Improvements

Ongoing and planned infrastructure projects are set to enhance the appeal of various regions for luxury property investment.

9.3 Emerging Locations

Lesser-known islands and mainland coastal areas are emerging as new hotspots for ultra-premium real estate development.

10. Conclusion

Investing in Greece’s ultra-premium real estate market, particularly properties with private beach access, presents a unique opportunity for discerning investors. The combination of exclusivity, natural beauty, and potential for appreciation makes these properties highly attractive in the global luxury real estate landscape.

As Greece continues its economic recovery and solidifies its position as a premier luxury destination, the ultra-premium property market is poised for sustained growth. However, investors must navigate complex legal and economic factors, emphasizing the importance of thorough research and expert guidance.

The allure of owning a piece of Greek paradise, complete with a private stretch of Mediterranean coastline, remains a powerful draw for high-net-worth individuals worldwide. As sustainability and privacy become increasingly valued, properties offering these features are likely to see enhanced demand and appreciation.

Ultimately, while the Greek ultra-premium real estate market offers significant potential, it requires a nuanced understanding of local dynamics, economic trends, and global luxury market patterns. For those willing to invest the time and resources, the rewards can be as spectacular as the views from a private villa overlooking the Aegean Sea.

FAQs

-

Q: What are the primary advantages of investing in Greek ultra-premium real estate with private beach access?

A: The main advantages include exclusivity, potential for high appreciation, rental income opportunities, and the lifestyle benefits of owning a luxury property in a prime Mediterranean location. Private beach access adds significant value due to its rarity and the privacy it offers.

-

Q: Are there any restrictions on foreign ownership of luxury properties in Greece?

A: While Greece generally allows foreign ownership of real estate, there are restrictions in certain border areas and some islands. It’s crucial to conduct thorough due diligence and consult with local legal experts before making an investment.

-

Q: How has the COVID-19 pandemic affected the Greek ultra-premium real estate market?

A: Initially, the pandemic caused a slowdown in the market. However, it has also increased demand for private, secluded properties, particularly those with ample outdoor space and private amenities. This trend has benefited the ultra-premium segment, especially properties with private beaches.

-

Q: What should investors consider regarding the seasonal nature of Greek tourism when investing in luxury rental properties?

A: Investors should plan for peak rental periods during the summer months and potentially lower occupancy in the off-season. This seasonality affects cash flow and may require strategic marketing and property management to optimize year-round returns.

-

Q: How do sustainability trends impact the Greek ultra-premium real estate market?

A: Sustainability is becoming increasingly important in the luxury real estate sector. Properties incorporating eco-friendly design, energy-efficient technologies, and involvement in local conservation efforts are gaining popularity among high-net-worth buyers, potentially offering better long-term value and appeal.

Article reviewed by Marco Rossi, Private Equity Portfolio Director | Transforming Distressed Assets into High-Performance Investments, on April 1, 2025